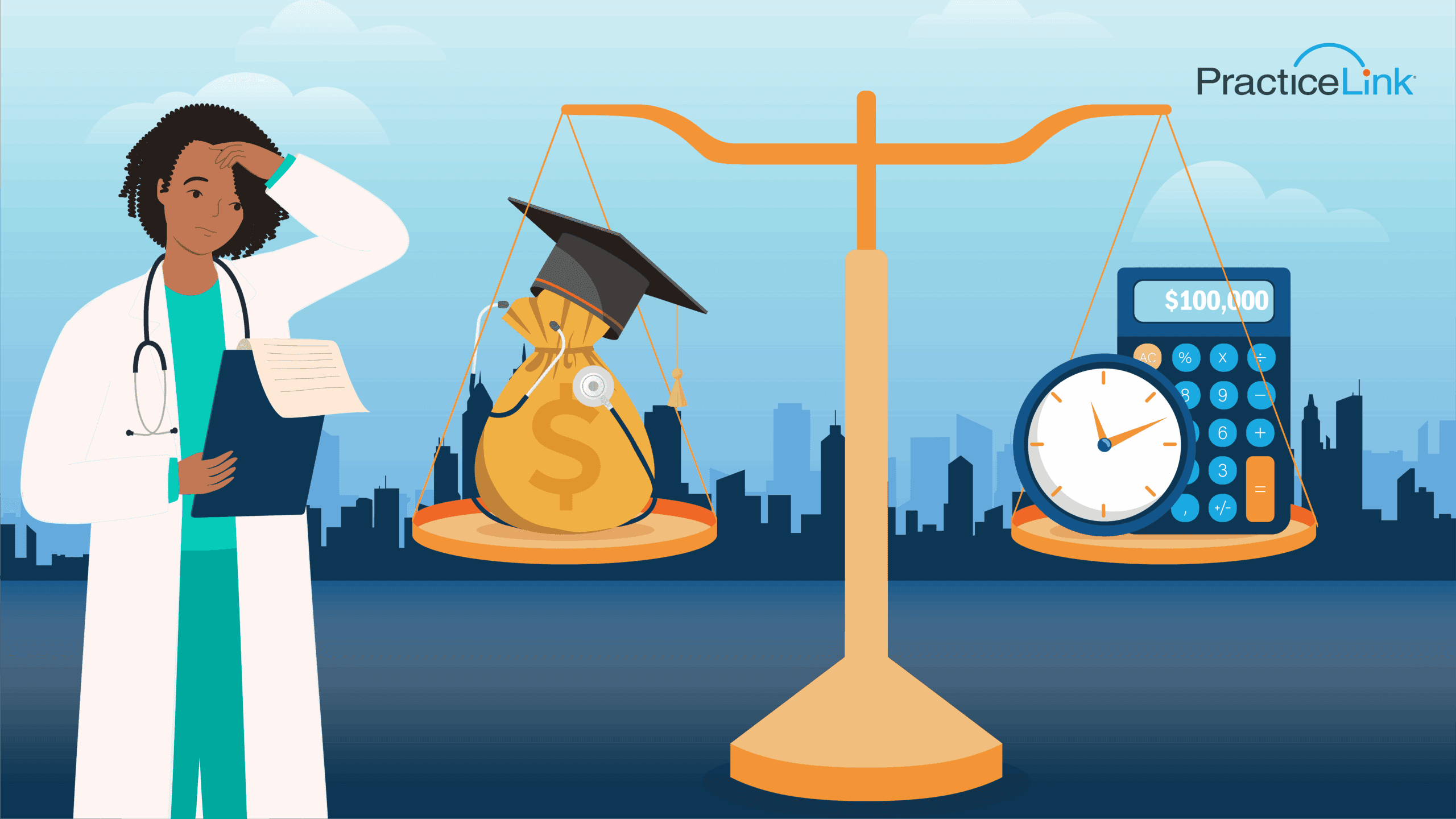

How long would it take to pay off $100,000 in a student loan?

By Megan Trippi September 27, 2025

How long would it take to pay off $100,000 in a student loan?

Paying for higher education is a significant investment, and for many borrowers, a $100,000 student loan can feel overwhelming. For medical students and physicians, this financial challenge is even greater since years of training often delay repayment. Understanding how long repayment takes — and what tools or strategies can shorten that timeline — is essential for making informed financial decisions.

For context, physician student loans often total more than $200,000, meaning a $100,000 loan is actually on the lower end of what many doctors face after medical school. Monthly repayment amounts vary, but exploring repayment schedules can help you understand the commitment ahead. Knowing the average medical school debt monthly payment also provides perspective on how these obligations compare across the profession.

How long would it take to pay off 100000 in a student loan?

How long does it take to pay off student loans on average? The timeline for repaying $100,000 depends on your repayment plan, interest rate and monthly contribution. The average time to pay off 100k student loans ranges from 10 to 25 years.

- Standard Repayment Plan: With fixed payments over 10 years (possibly 10 to 25 years next summer), borrowers might pay around $1,000 per month, depending on interest.

- Extended Repayment Plan: This spreads the balance over 20–25 years, lowering monthly payments but increasing total interest paid.

- Aggressive Repayment: Paying more than the minimum can cut the timeline in half, saving thousands in interest.

For professionals like physicians, higher post-residency salaries may allow for faster repayment if they prioritize student debt early in their careers.

How long does it take for a student loan to be paid off?

This question has no one-size-fits-all answer. Some graduates clear their loans in under a decade, while others carry balances into the middle of their career. To get a personalized estimate, use a How long will it take to pay off my student loan calculator.

These calculators consider:

- Principal balance

- Interest rate

- Chosen repayment plan

- Extra monthly contributions

For example, a $100,000 loan at 6% interest on a 10-year plan results in payments of about $1,110 per month. Paying an extra $200 per month could shorten repayment by almost two years and save thousands in interest.

How do you calculate interest on a student loan?

Interest is what makes loan repayment feel endless, especially on large balances. A student loan interest calculator helps borrowers see exactly how much of their monthly payment goes toward interest versus principal.

Here’s how it works:

- Identify your interest rate: For graduate loans, rates are often between 6% and 7%

- Apply the daily interest formula: (Loan balance × interest rate) ÷ 365 = daily interest accrual

- Multiply by days in billing cycle: Estimate interest for the month

For a $100,000 loan at 6%, interest accrues at about $16.44 per day — or nearly $500 each month. If you only pay the minimum, it can take years before the principal begins to shrink significantly.

How long does it take the average person to pay off student loan debt?

Across all borrowers, the repayment journey is long. The average borrower takes about 20 years to pay off student loans, though this number varies by degree type and income level. For those with larger balances, repayment can stretch much longer without aggressive strategies.

Typical student loan payment schedules look like this:

- Undergraduate borrowers: 10–15 years on average

- Graduate borrowers (including physicians): 20–25 years without forgiveness programs

- Borrowers pursuing forgiveness: May qualify for balance cancellation after 10–20 years, depending on the program

This highlights the importance of exploring repayment plans early, setting realistic budgets and using available calculators and financial tools to project your timeline.

A $100,000 student loan is a serious financial responsibility, but understanding repayment options helps make the process manageable. On average, repayment can take 10–25 years, depending on income, interest rates and repayment plans. Tools like repayment calculators and interest estimators make it easier to project monthly obligations and find opportunities to save.

For medical students and physicians, debt is often even higher, but strategies like refinancing, accelerated payments and forgiveness programs can shorten the timeline and reduce stress.

Want to learn more about managing the financial side of your medical career? Explore our resources on physician student loans for repayment strategies, forgiveness options and expert insights.